The Difference Between a BPO, BMA, CMA And Appraisal

Many homeowners do not know the difference between a Broker Price Opinion (BPO), a Broker Market Analysis (BMA) and a Comparative Market Analysis (CMA), and an Appraisal. The reason these terms are often used interchangeable is because of who prepares them.

A Realtor and/or Real Estate Broker can prepare a BPO, BMA & CMA. The assumption that a BPO, BMA and CMA are the same thing is incorrect. A Certified Residential Appraiser, or a Licensed Appraiser (in some states) has to prepare an Appraisal.

All of these are not to be confused with an AVM – which is an Automated Valuation Model. Many people also confuse the appraisal with a home inspection – this comes from the very basic inspection completed on VA loans.

What Is A BPO

A BPO is prepared by a Real Estate Professional and is considered a more  accurate version of a CMA. The BPO can be ordered by a bank, a lender or a homeowner to determine value of a property.

accurate version of a CMA. The BPO can be ordered by a bank, a lender or a homeowner to determine value of a property.

This value may be used for consideration in the following, but not limited to:

- Foreclosure Process

- Short Sale

- Late Payment

- Loan Modification

- Refinance

- Setting A Listing Price

- Removal of PMI

- Loan Being Sold, etc.

A BPO is less expensive than a full-blown Appraisal because of who it is prepared by. Educated mortgage lenders will sometimes choose the BPO because it is less expensive. It is important to know that BPO’s are not legal in all states. BPO’s often restrict the preparer on what adjustments can be made simple because many BPO forms do not have fields for “adjustments”. There is two commonly used BPO formats, the drive by BPO and the interior BPO.

The Drive By BPO

The drive by BPO is exactly what the name says it is. The Real Estate Professional is not required to enter the subject property to conduct an interior inspection. They are still required to complete the research to provide information on the subject property, comparable properties and submit photographs of the exteriors.

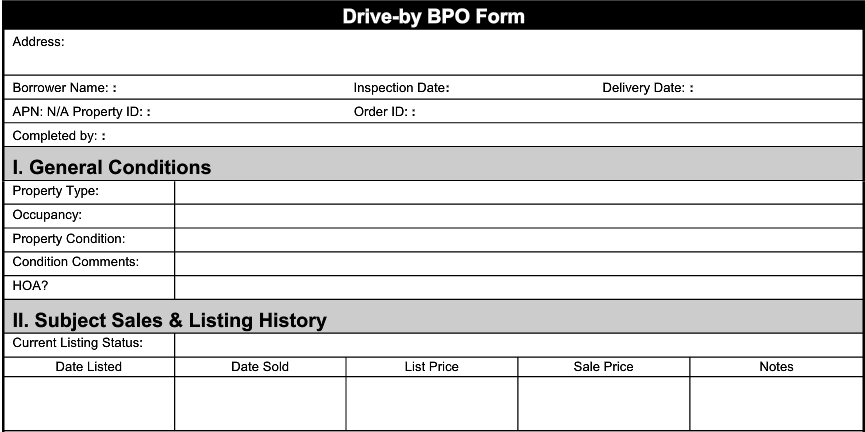

Below is a snippet of the top of the Drive By BPO form used by most Real Estate Professionals, and is titled “Drive-by BPO Form”.

*Note: This is not the form in it’s entirety

The Interior BPO

The interior BPO requires the prepareer to do all items as required in the drive by in addition to a physical inspection of the interior. Interior pictures will be required, and visual inspection of comparable properties if used in the preparation of the BPO.

What Is A BMA and CMA

The difference between a BMA and a CMA is quite simply what they are used for. They both gather real estate market data in regard to the subject property.

The BMA was introduced to the Real Estate Industry when Relocation Companies began using Broker’s to list and market their relocation client’s home. They want to compare the home they are working with to the other homes or condos for sale on the market. The Broker is required to come to a conclusion of the best sales price for the subject property within a marketing period generally not to exceed 90-120 days.

Relocation companies will request more than one BMA when selecting a Listing Agent. The comparable sold data will likely be the same across the board, so the Real Estate Broker with the least commission and best marketing strategy will likely win the Listing.

The CMA is prepared also by a Licensed Realtor, but it is used to provide a seller and/or a buyer, an opinion of the best sales price. The REALTOR will use the CMA with Buyer’s, as well as Seller’s, to make adjustments and then calculate the square footage of comparable properties. Although just about every seller agent will complete a CMA on a property they are going to list, fewer buyers agents complete a full CMA. There are exceptions, some REALTORS that work exclusively with buyers will make that part of their value proposition. REALTORS that are proficient in technology have programs that can assist in that process,. After coming to a price per square foot, that is then calculated by the living square foot of the subject property.

Selection Of Best Comparable Property Is Crucial

When home owners receive CMA’s from REALTORS, it is important that the  REALTOR used properties that are similar to the subject property, and have recently sold. Four (4) Realtors who select even one different comparable will come up with a different sales price. The homeowner will typically go with the Realtor that suggests the highest number, and usually it is not a realistic sales price.

REALTOR used properties that are similar to the subject property, and have recently sold. Four (4) Realtors who select even one different comparable will come up with a different sales price. The homeowner will typically go with the Realtor that suggests the highest number, and usually it is not a realistic sales price.

What Is An Appraisal

An Appraisal is prepared by a Certified Residential Appraiser who has a career in determining property value. An Appraisal is more complex than the other opinions of value listed above. It includes information from public records as well as inspection of the interior and exterior of the subject property.

An Appraisal will utilize current market conditions including, but not limited to, active, sold and pending properties similar to the subject property. The detail and research required to complete an Appraisal results in this approach to value being more expensive than a BMA, BPO or CMA.

In addition, when getting homeowners insurance, your insurance agency will use the appraisal value of the home to better understand how much the property should be insured for. The lender will usually require that the home be insured for the mortgage amount, but many homeowners will want enough insurance to rebuild the property in case of a catastrophic issue.

Appraisals can be ordered by, but not limited to:

- Banks/Mortgage Lenders For The Purpose Of Approving a Loan

- Attorneys For Estate Planning or Community Property Settlements

- Construction Loans

- Insurance and Tax Valuations

- Homeowners For A Suggested Sales Price

The Best REALTORS

Truth is, the best REALTORS go through a very similar process as an appraiser to get their opinion of value. As a general rule, real estate agents are looking to price a single family home. Because the pricing of single family properties generally go off of the “comparable method” which is one of the methods used by Appraisers. Although a common practice offered by agents, many don’t have the experience to provide an accurate CMA. For an example of a REALTOR who completes accurate CMA’s in the Savanna GA Area – CLICK HERE

When completing an appraisal, appraisers must come up with a value using two of the three methods – then choose the most accurate method for the subject property. The best REALTORS will only complete the opinion of value using the comparable method — but can (and in many instances do) come up with very similar results.

How To Decide Which Approach To Value You Need

Based on what you need the value for and how much money you are willing to spend, can help you decide between which approach to value best fit’s your needs. You  can start by contacting a local REALTOR or Appraiser and explaining to them what your needs are. If you are applying for a mortgage to buy a home, the Lender or Bank will require and order the Appraisal on your behalf.

can start by contacting a local REALTOR or Appraiser and explaining to them what your needs are. If you are applying for a mortgage to buy a home, the Lender or Bank will require and order the Appraisal on your behalf.